S&P 500 Forecast for Wednesday, April 21, 2021

- Kapproveb Alcyone

- Apr 19, 2021

- 2 min read

Updated: Aug 8, 2022

***********

93% (13 correct statements out of 14 statements.)

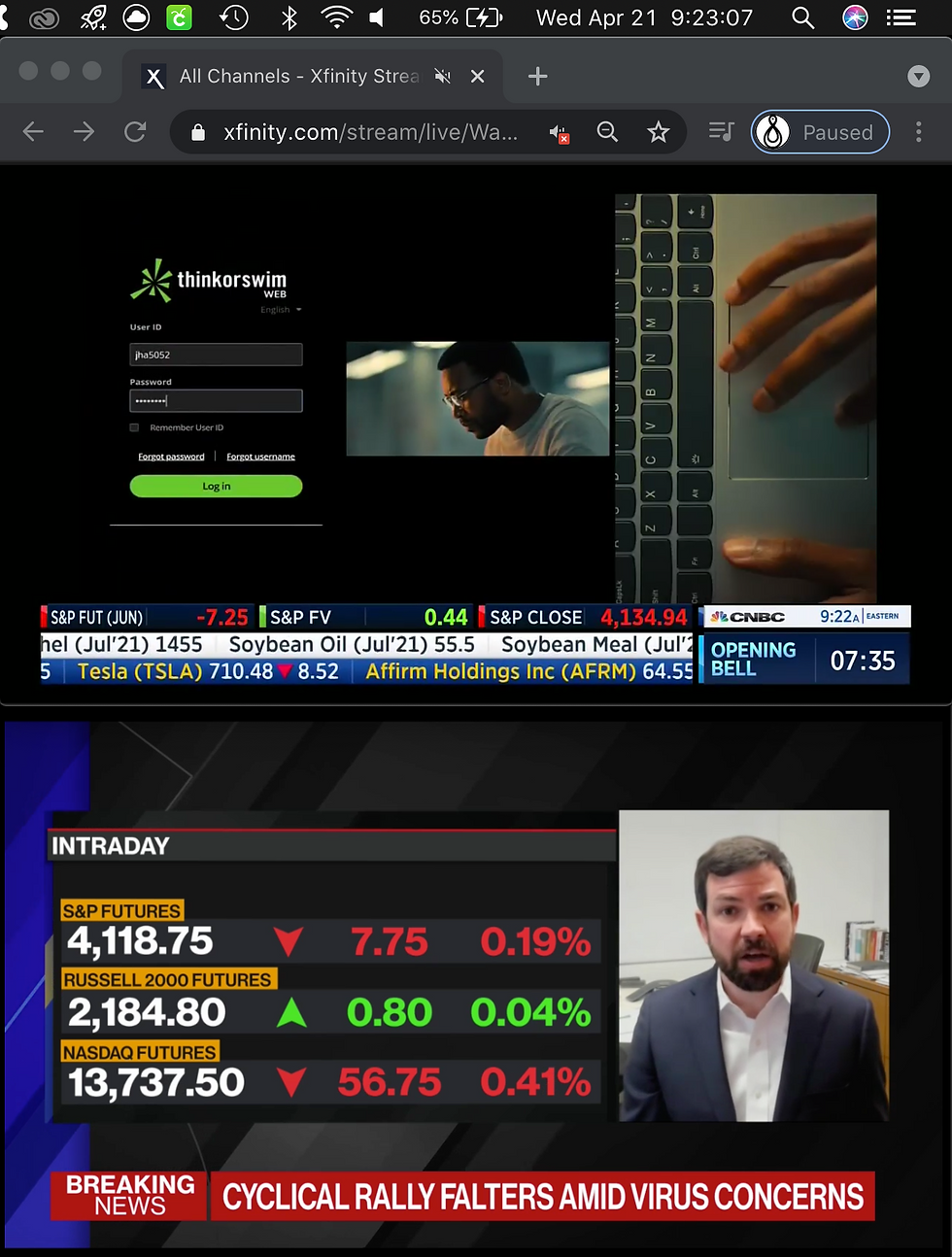

I am presented with an opportunity to protect gains and/or open bearish positions today while the S&P 500 is rallying. In the premarket a male leader in business or a male celebrity provides inspiration/motivation with a new innovative idea/solution that involves an improving view of the financial situation. Movement of the S&P in the premarket reflects an increase in investors’ motivation which pushes the market higher. Right around the open a temporary pause in the rally pushes the S&P into sideways movement crossing the one support/resistance line three times. Between the open and approximately 10am a pending decision gets the green light AND/OR a very strong bullish move occurs out of the early morning low. The rally transitions into sideways fluctuations between roughly 10am and 11am. Between approximately 11am and 12pm a crest forms during a period of bullish rotation into defensive positions. This behavior reflects the Street’s willingness to rally through a struggle despite no clear end in sight. Roughly between the hours of 12pm and 1pm sudden bad news sends the S&P into a sharp decline. A second trough/low forms between 12pm and 2pm when courageous bulls "buy the dip" causing a rally that fully retraces its preceding decline. The days second crest forms between approximately 2pm and 3pm when a failed retest of the preceding high becomes another decline that transitions into a bearish rotation before 3pm. Sideways bullish price swings are exhibited in the last hour of trading. Environmental issues are highlighted at this time. A notable spike higher right around the close leads the S&P to a third crest which forms between the close and the post market. In the post market EITHER/BOTH (1) a reversal off of a resistance level AND/OR (2) a decline through a support level. Either path leads to a reversal off of an already established support level. At that support another reversal is followed by a rally climbing all the way back to the aforementioned support/resistance level. At this resistance level the S&P then reverses again, declining back down to revisit the same level as that of the preceding support.

#MoonLeoOppositionSaturnAquarius @1:56am est.

#MoonLeoQuincunxNeptunePisces @7:07pm est.

#93%Accuracy

#Tarot #traders #FinancialMarkets #SPX #StandardAndPoors #Stockmarket #EsotericAnalysis #StockMarketPrediction #StockMarketForecast #2020Forecast #Precognition #S&P500

#2020stockmarket #BeatTheMarket #DayTradingGuidance #TarotAndStockMarket #DayTrading #PatternTrading #SwingTrading #StockMarketPsychic #S&P

Comments