S&P 500 Forecast for Monday, May 10, 2021

- Kapproveb Alcyone

- May 6, 2021

- 2 min read

Updated: Aug 8, 2022

***********

92% (11 correct statements out of 12 statements.)

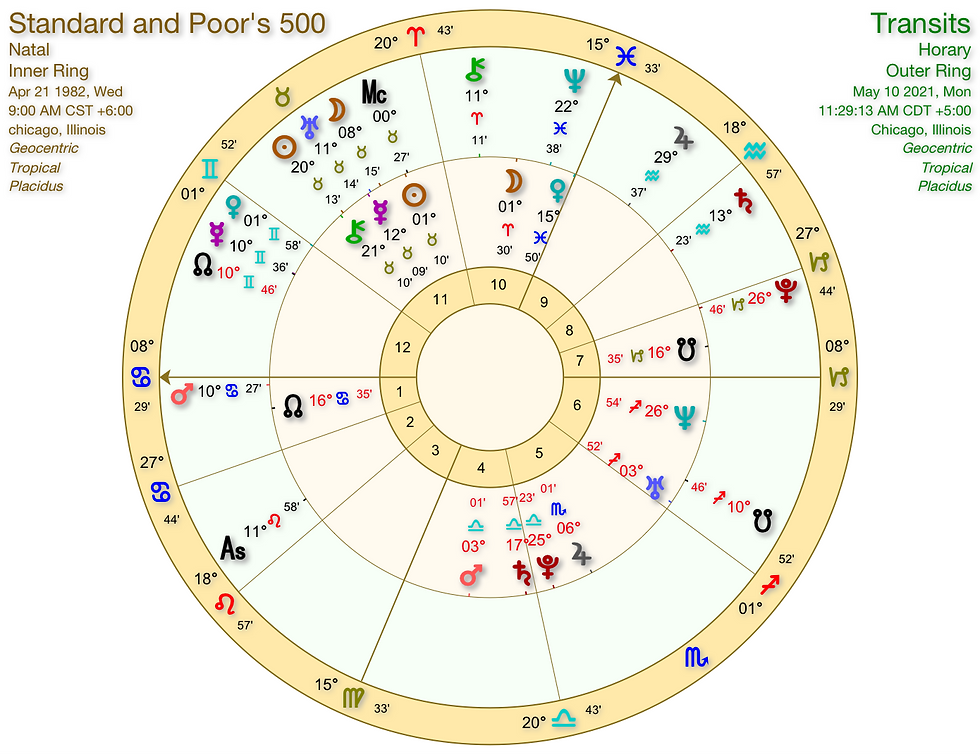

Today's theme is that of a change in fortune. The main highlight of the S&P 500 behavior for today is a reversal. In the premarket investors are inundated with choices causing confusion and indecision. This is reflected by the S&P 500 testing resistance twice before breaking down through a support level then bouncing along the next support level before breaking down through multiple support levels. Right around the open sideways bullish rotation reflects defensive sentiment yet investors are determined to move higher. Right around the open through 10:00 AM I am presented with an opportunity to [take profits] AND/OR [take credits] through [short selling] AND/OR [options contracts]. From the open through roughly 11:00 AM the S&P finds and tests support before moving higher out of a day's low. From right around 11:00 AM a powerful move higher on huge volume breaks out through two resistance levels while traveling along a diagonal trend line. The rally continues through around 12:10 PM at which point there is a transition into flat sideways movement with light volume; negotiations at a standstill are highlighted at this time. Between roughly 12:00 PM and 2:00 PM the S&P pokes through the same resistance line 3 times before declining. Added that decline and around 2:00 PM an extremely powerful rally commences with a very noticeable strong jump higher out of a [decline] AND/OR [trough]. An economic leader is highlighted in the last hour of trading further fueling the rally with bullish rotations around the close. With overall significant moves higher right around the close there's another [powerful move higher] AND/OR [a major rally as stocks jump]. In the post market the strong rally continues to move the S&P 500 higher even in the face of seemingly overwhelming headwinds. A further note the S&P activity around the day's high will be marked by flat movement on low volume. The day's lows are marked by declines from a peak down to support level.

#MoonTaurusSextileMarsCancer @5:12pm est.

#MoonTaurusConjunctionUranusTaurus @6:35pm est.

#MercuryGeminiSextileChironAries @10:44pm est

#MoonTaurusSquareSaturnAquarius @10:55pm est.

#92%Accuracy

#Tarot #traders #FinancialMarkets #SPX #StandardAndPoors #Stockmarket #EsotericAnalysis #StockMarketPrediction #StockMarketForecast #2020Forecast #Precognition #S&P500

#2020stockmarket #BeatTheMarket #DayTradingGuidance #TarotAndStockMarket #DayTrading #PatternTrading #SwingTrading #StockMarketPsychic #S&P

Comentarios