S&P 500 Forecast for Friday, May 21, 2021

- Kapproveb Alcyone

- May 21, 2021

- 3 min read

Updated: Aug 8, 2022

***********

93% (14 correct statements out of 15 statements.)

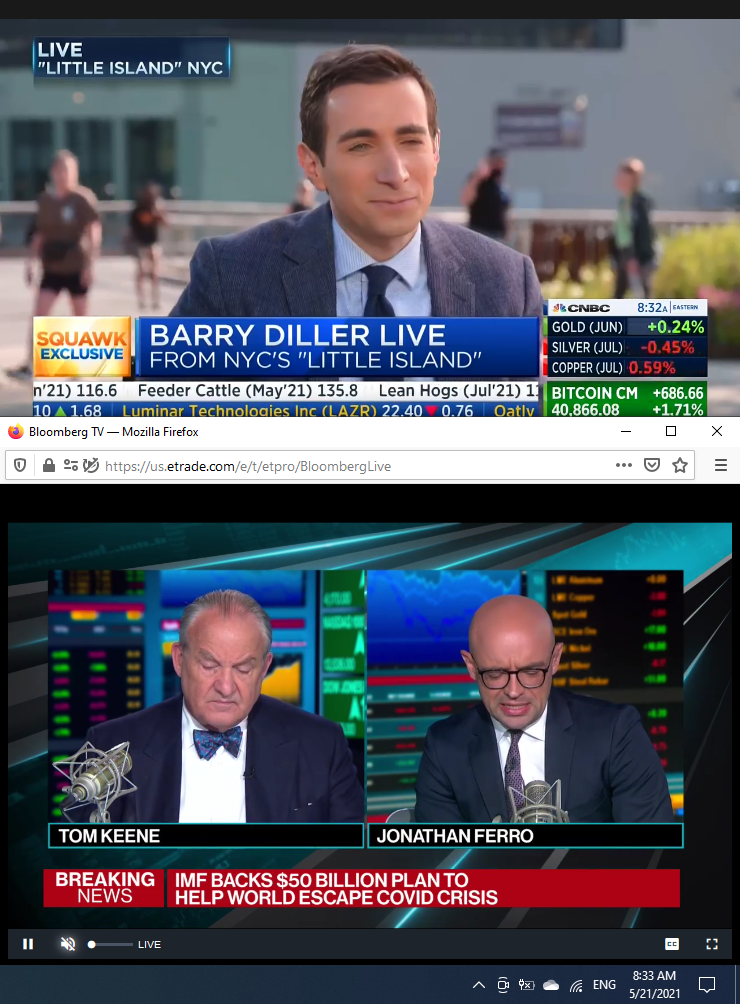

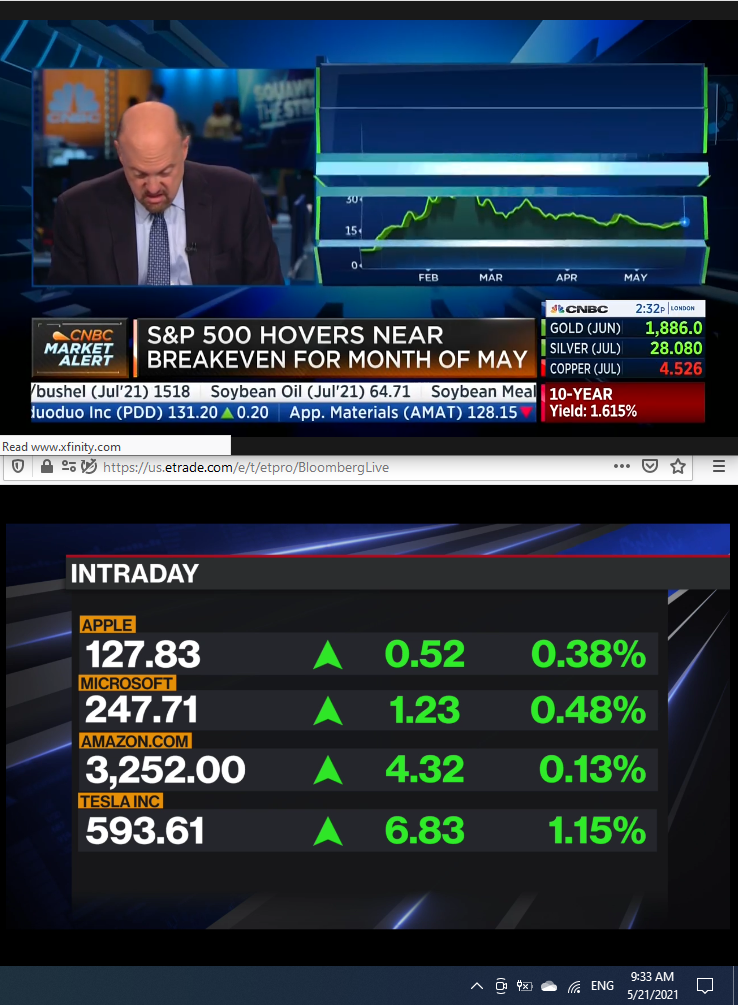

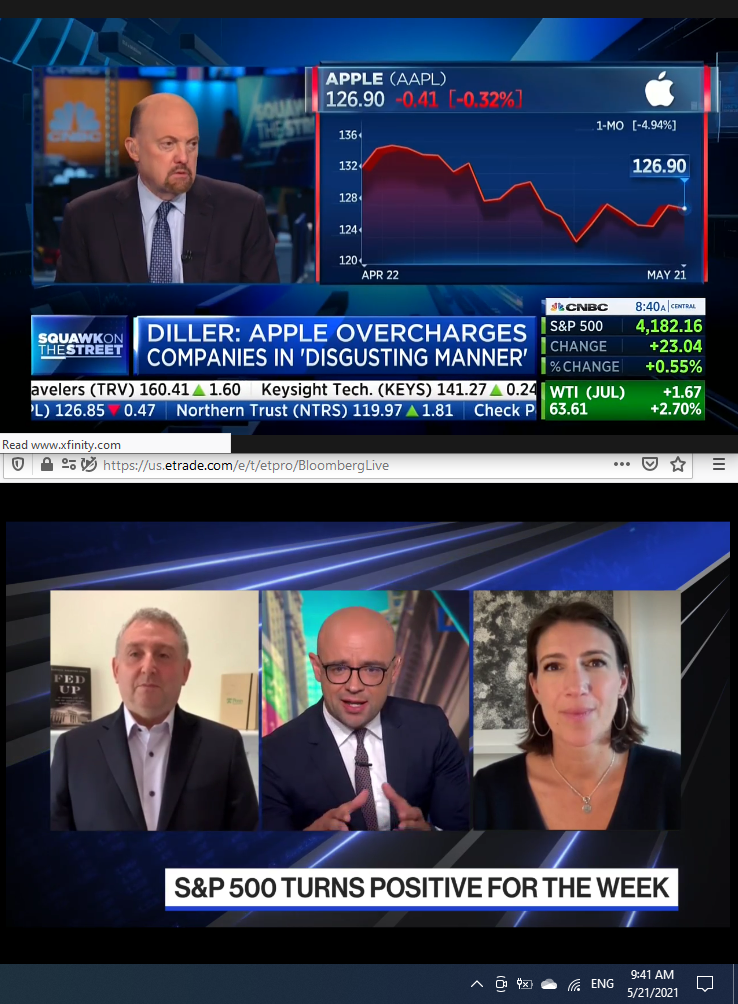

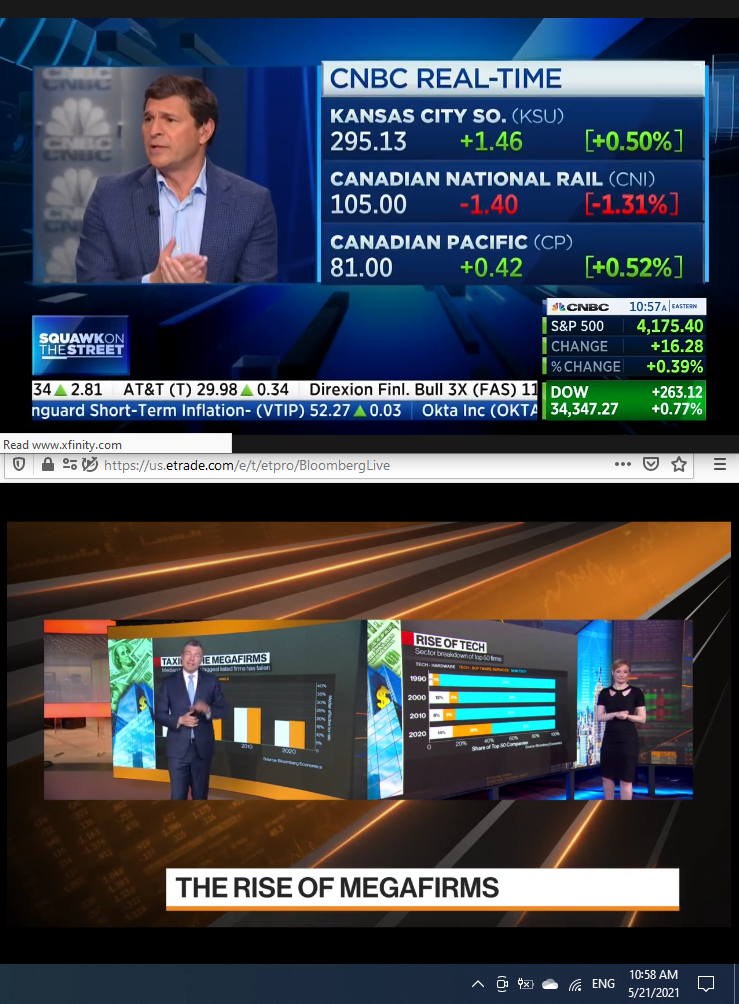

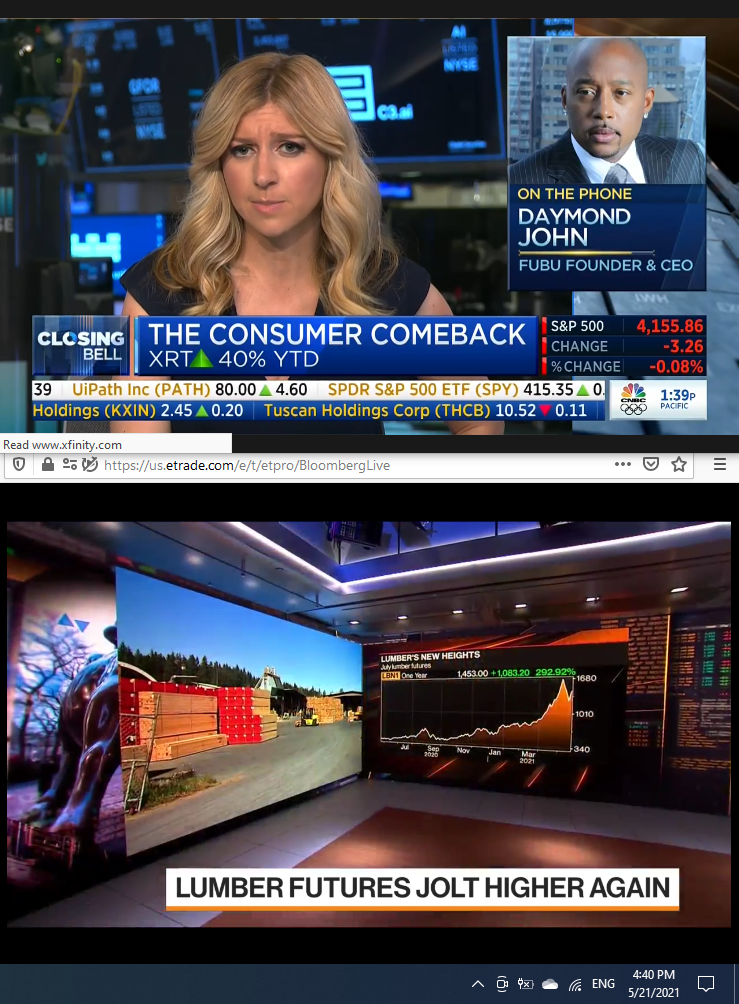

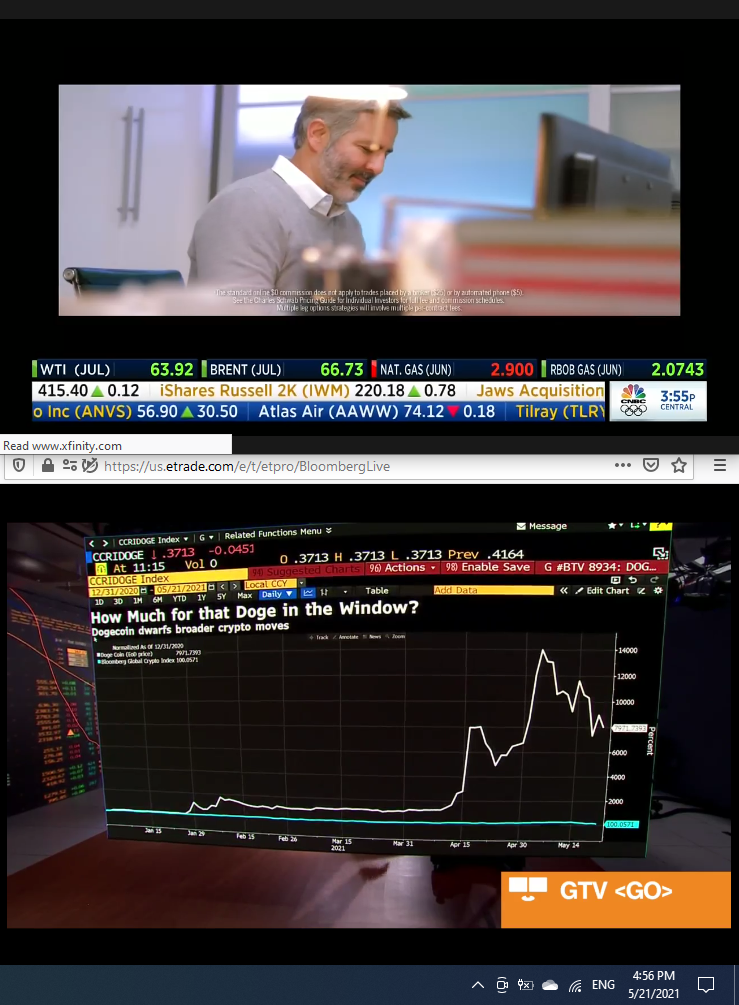

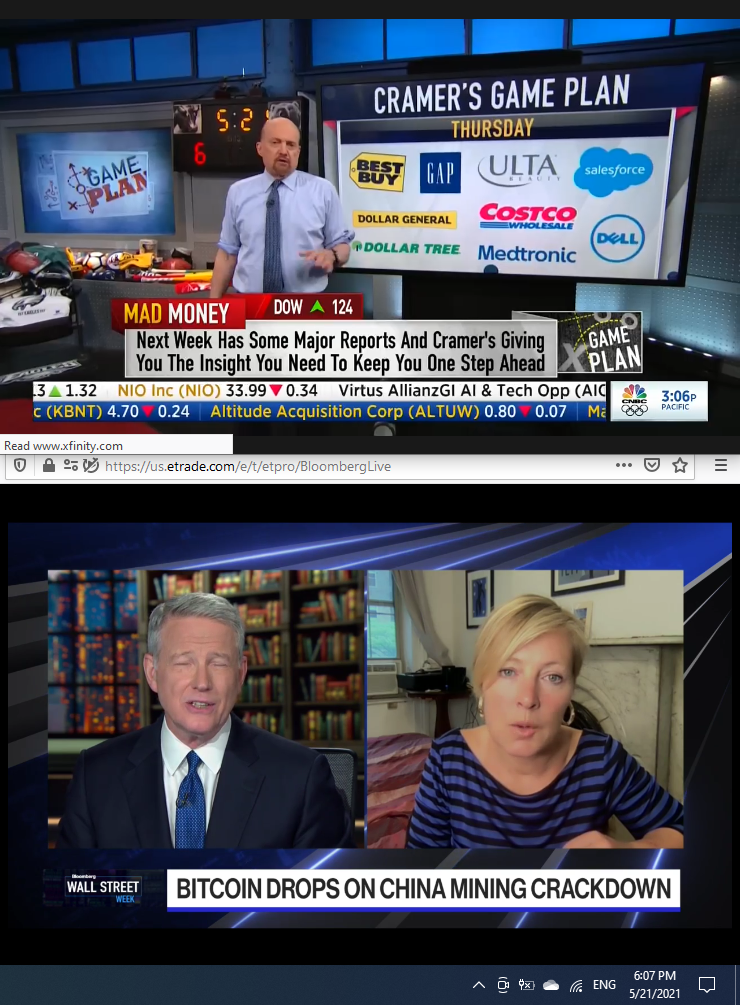

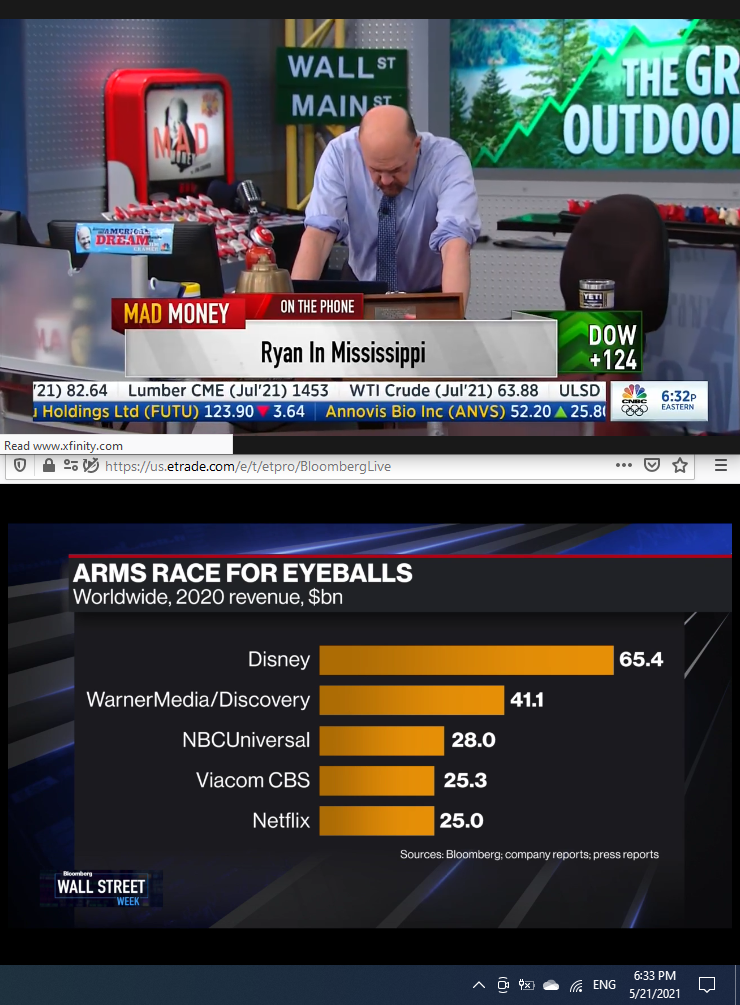

Bad news that produces a temporary financial crisis having to do with unemployment and/or heavy debt are highlighted today. The overall behavior of the S&P 500 is that of a bearish consolidation. In the pre-market, we see sideways fluctuations on higher than average volume as the market exhibits a rebalancing. Right around the open there is a strong rally. Between the open and roughly 10 AM EST there are multiple attempts to break out through key resistance. A leader making an impactful decision is highlighted between roughly 10 AM and 11 AM EST. A significant move higher out of a strong decline is exhibited. He provides great motivation and sentiment on the street becomes definitively bullish. There may be an absence of reason and extreme greed and confidence exhibited by a powerful move higher on huge volume between the hours of roughly 11 AM EST and 12 PM EST. From 12 PM to roughly 1 PM EST, the S&P 500 establishes support, testing and confirming a technical level before moving higher. Between the hours of 1 and 2 PM EST, a high is formed within a period of consolidation. The street sentiment is that of trusting that things will improve soon, but this high is short lived as there’s a pullback after breaking through a horizontal resistance along a diagonal trend line. There’s a breakdown right around 1:45 PM EST. A day’s high is formed around 1:25 - 1:30 PM EST. There’s an opportunity for myself to trade here from the high to the low, possibly at the low as well to the following high. A leader is highlighted providing motivation and inspiration, yet there’s a breakdown through a diagonal trendline after a high or crest and/or after a notable rally along a trend line. In the last hour of trading, a short lived peak and or crest forms when price moves up through a resistance to reach a notable peak before falling back down to the same level it had breached previously. Right around the close, there’s a temporary pause where investors take a break to reconsider positions and flat volume is exhibited, only momentarily. In the post market and possibly at the open as well, something impossible happens. There’s a turn for the better. Stocks soar on a very strong upward move reaching for a high. The behavior around the low of the day is marked by a strong bullish move out of a strong decline. The day’s high is marked by buyer’s remorse, a breakthrough of a horizontal resistance level while traveling along a diagonal support level, followed by a pullback through the aforementioned horizontal resistance level due to buyers remorse. I advise myself to trade around the reversal. A chance meeting changing street sentiment is a signal for timing my trade. Sneak peak into tomorrow is that there is an unexpected opportunity where the improbable happens. Free members of TheInvestorProphet.com read these forecasts days in advance. Subscribe now.

#MoonVirgoSquareMercuryGemini @7:47am est.

#MoonVirgoOppositionNeptunePisces @9:24am est.

#SunGeminiSquareJupiterPisces @11:03am est.

#MoonVirgoTrinePlutoCapricorn @3:56pm est.

#MoonEntersLibra @9:35pm est.

#MoonLibraQuincunxJupiterPisces @10:59pm est.

#MoonLibraTrineSunGemini @11:46pm est.

#93%Accuracy

#Tarot #traders #FinancialMarkets #SPX #StandardAndPoors #Stockmarket #EsotericAnalysis #StockMarketPrediction #StockMarketForecast #2020Forecast #Precognition #S&P500

#2020stockmarket #BeatTheMarket #DayTradingGuidance #TarotAndStockMarket #DayTrading #PatternTrading #SwingTrading #StockMarketPsychic #S&P

Comments