October 10, 2022 S&P 500 Predictions (RATED)

- Kapproveb Alcyone

- Aug 30, 2022

- 2 min read

Updated: Dec 1, 2022

*Accuracy rating update: 100% or 17/17 predictions correct*

Theme:

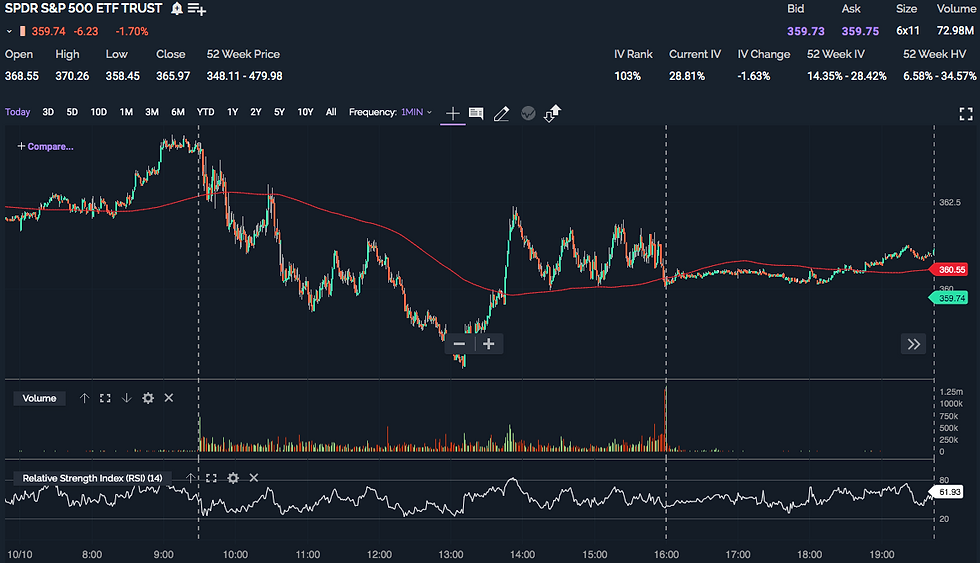

A notable drop that will stand out on a one-day chart in the midst of bearish price swings. Around the high, there’s a decline that marks an opportunity to open a long position. At the low near the middle of the day, there’s a trade opportunity.

Overview:

On October 10, 2022, we have some sideways rotation in the pre-market. There’s also a new support level that’s highlighted. Around the open, we have a big move to the upside that reaches a high for the day. From that high, we have a notable decline on a one-day chart. That decline marks an opportunity to open up a long position around 9:45 a.m. Between roughly 10:00 a.m. and 11:00 a.m., there’s a decline to and through support to meet a secondary support level. We rotate sideways along that new support level. Between roughly 11:00 a.m. and noon, there’s a big move to the upside off of that support level to reach a distant resistance level. At this time, I’d likely sell the calls purchased earlier in the day. Following the move to the upside, there’s a notable drop around midday in the form of a U-shaped dip. The bottom of this dip will mark a low for the day. Out of this U-shaped dip, there’s a big move higher in the midst of some price swings. This move to the upside, likely in the form of a crest, will break through horizontal resistance to meet secondary resistance and will pull back to somewhere between those two price levels.

From that brief move into a crest, we’ll see a notable drop. This is followed by a big move to the upside to form another crest at the end of the day. Toward the close, we’ll then see a failed attempt to break through key resistance on a one-day chart followed by a decline through key support on a one-day chart. In the post-market, there’s a move to the upside that would likely stand out on a one-day chart.

Sneak preview:

A decline to and through support. We then turn around and reuse that support level.

Comments